35+ Mileage Tax Deduction Calculator

1 2024 the standard mileage rates for the use of a car van pickup or panel truck will be. Web The IRS mileage rate for 2023 is 655 cents per mile for owning and operating your vehicle for business purposes.

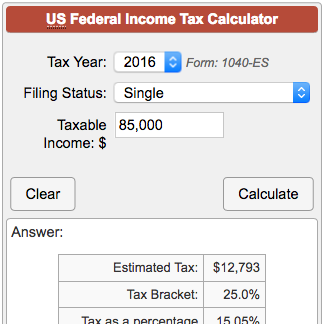

Income Tax Calculator

It includes factors like gasoline prices wear-and-tear and more.

. Web Multiply business miles driven by the IRS rate. You need to know the rules for claiming mileage on your taxes and more importantly you need to keep careful records. The real estate agent can claim 9825 as a deduction for using the EV for.

A rate of 585 cents a mile applies to. Web The short version The IRS sets a certain amount each year that businesses can use to calculate their exact mileage deduction. Web March 21 2023 at 1230 pm.

Web Master mileage tax deduction logs with our guide. Web Mileage Reimbursement Calculator. Web Last quarterly payment for 2023 is due on Jan.

Web The mileage tax deduction rules generally allow you to claim 063 per mile in 2022 if you are self-employed. Theres no limit to the. Taxpayers may need to consider estimated or additional tax payments due to non-wage income from.

15000 miles x 0655 per mile 9825 Mileage Deduction. To find out your business tax deduction amount multiply your business miles driven by the IRS mileage deduction. Dont worry if you use multiple vehicles.

Miles rate or 1200 miles 0655. Web Standard Mileage Method - You can multiply your business miles driven by the IRS mileage rate of 655 cents current IRS mileage rate. Actual Expenses Method - You can track.

For 2023 its 655 cents per mile. The IRS sets a standard mileage rate in January of. Web The IRS has a standard mileage rate SMR for the business use of your personal vehicle.

Web What are the two mileage rates for 2022. Explore standard rates vs actual expenses and leverage MileageWise for optimal tax savings. Web That means the mileage deduction in 2022 2021 rate is different from previous years.

To use our calculator just input the type of vehicle and the business miles youve travelled in it for work. Web Get all the updated car mileage rates as issued by the IRS. You may also be able to claim a tax deduction for mileage in a few.

For the 2022 tax year youre looking at two mileage rates for business use. For medical expenses you can claim. Web There are two different mileage rates you can use to calculate your tax deductions.

Web 20p per mile. 14 2023 The Internal Revenue Service today issued the 2024 optional standard mileage rates used to calculate the deductible costs of operating an. You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical.

The rate for tax year 2023 is 655 cents per mile. Web The IRS has announced its 2024 standard mileage rates. Heres a breakdown of.

Tax For Teens Ppt

2023 Mileage Reimbursement Calculator Travelperk

How Is Car Lease Tax Benefit Calculated In India For Individual Salaried Employee Who Uses The Car For Both Official And Personal Purpose Can You Explain With An Example Quora

The Best App For 1099 Workers Streamline Your Business Track Your Income Expenses Easily And Maximize Your Profits

How To Calculate Mileage For Irs Taxes Or Reimbursement 2023 Updated

New Mileage Rate Calculator To Budget For Reimbursement Costs

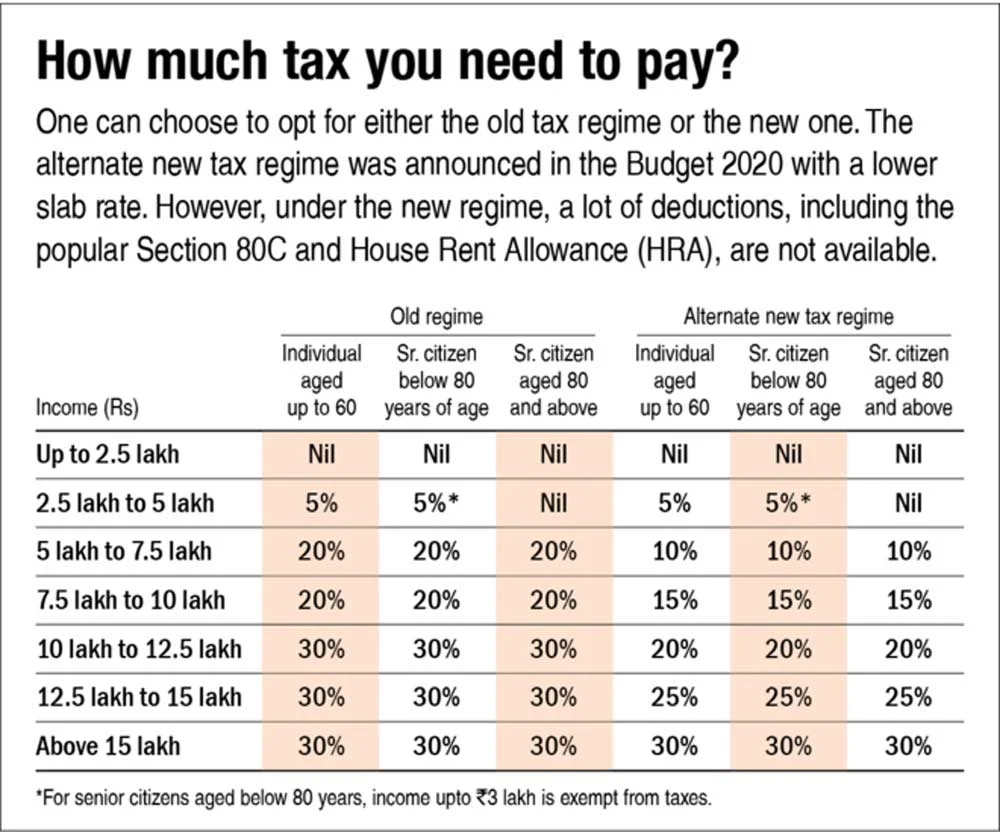

Tax Calculator Calculate Taxes For Fy 2023 24 Income Tax

How Much Savings Should I Have Accumulated By Age

Thomas James Carroll P C Mountain Lakes Nj

Sept 13 2012 Herald Union By Advantipro Gmbh Issuu

How To Write A Business Plan By Asim Zafar Issuu

Ex99 2 012 Jpg

Income Tax Calculation Fy 2023 24 Ay 2024 25 Old Income Tax Vs New Income Tax Calculator Youtube

.svg)

Free Irs Mileage Calculator Calculate Your 2023 Business Mileage

Walked Out On My First Route Ever Today R Amazonflexdrivers

Mileage Deduction Calculator 2023

How Much Is 35 000 Per Year After Tax